Financial account takeover crimes are exploding in the US. More than 5100 complaints have already been logged in 2025 and losses have passed $262 million. The pattern is the same every time. Criminals impersonate bank staff, spoof websites, and trick people into giving up login credentials and MFA codes. Individuals and businesses of every size are getting wiped out.

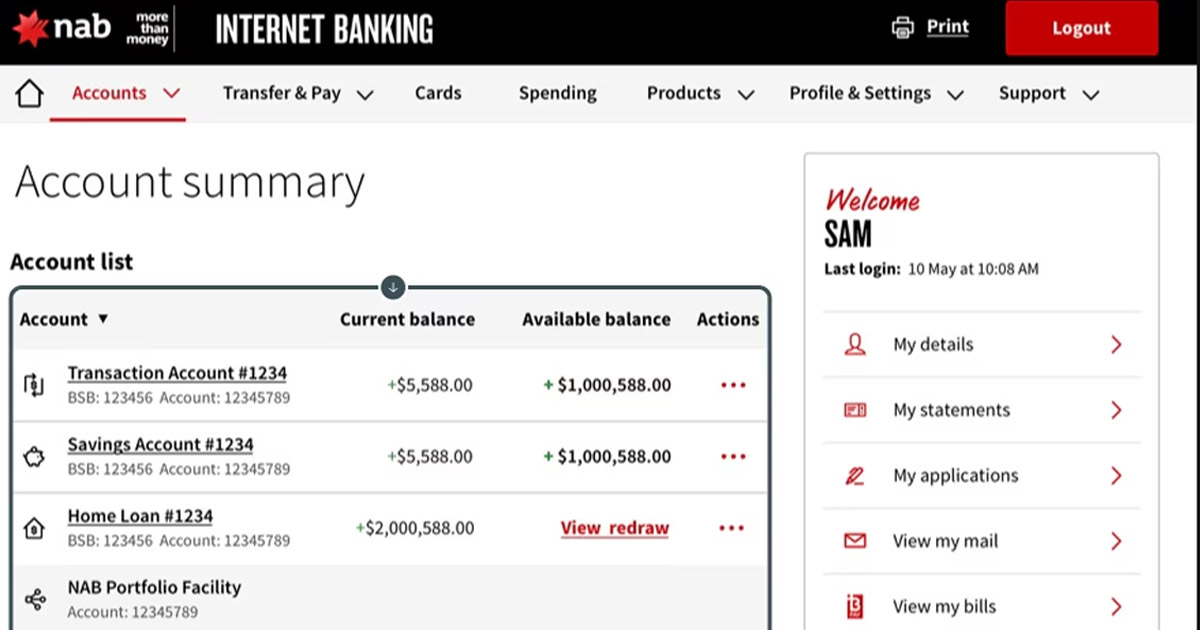

The entry point is usually a fake call, text, or email claiming to be from your bank. Or worse, a search ad that looks legitimate but routes you to a cloned phishing site. These copies mimic login pages closely. They look real because AI now helps build them. Some scams even lean on fake law enforcement pressure to push people into handing over sensitive details. Once attackers have credentials and a 2FA code they take over the account, lock out the real owner, and drain funds with wire transfers or crypto purchases. No alarm goes off. No one calls you back. The money is gone.

Even the main federal reporting site for cybercrime has been spoofed and pushed through search engine ads. Victims get funneled into fake IC3 pages that ask for private data and then get contacted by scammers pretending to be investigators to extract even more. AI and phishing kits are making this trivial. The templates are professional grade and the attackers barely need technical skills.

Holidays make it worse. Shopping spikes and so do scams. Criminals ramp up activity from Thanksgiving through New Year. The money is moving and so are the attacks. Small businesses are also in the crosshairs. Unpatched systems like Magento and WooCommerce are being hit daily. Old plugin, old version, forgotten subdomain. That is all it takes.

The usual advice gets repeated everywhere. Enable MFA. Monitor your accounts. The problem is that SMS and email MFA codes are easy to socially engineer out of people. If someone can trick you into believing a call or message is real they can trick you into handing over the code as well. What actually protects you is consistency, predictable habits, and locked down workflows. Bookmark your bank login and never search for it. Treat every unsolicited message as hostile until it is proven otherwise.

If you do get hit, contact your bank immediately and request reversal of transfers. File a report at ic3.gov. Then contact the impersonated company. They can help get spoofed sites and ads taken down quickly. This surge in takeovers is only the beginning. As long as credentials are the key, attackers will keep finding ways to talk people out of them. The real fix is to stop using passwords entirely.

Blackout VPN exists because privacy is a right. Your first name is too much information for us.

Keep learning

FAQ

What is a financial account takeover?

It is when a criminal gains access to your account by stealing login credentials and bypassing security to take full control.

How are attackers getting around MFA?

They impersonate support staff and trick users into giving up MFA codes during live scams.

What role does AI play in these attacks?

AI helps criminals craft convincing emails, clone websites, and automate social engineering.

What should I do if I think I was targeted?

Stop all communication, contact your bank, report at ic3.gov, and alert the spoofed organization.

How can I avoid these scams?

Never trust unsolicited messages, use bookmarked URLs, and avoid search engine ads for login links.